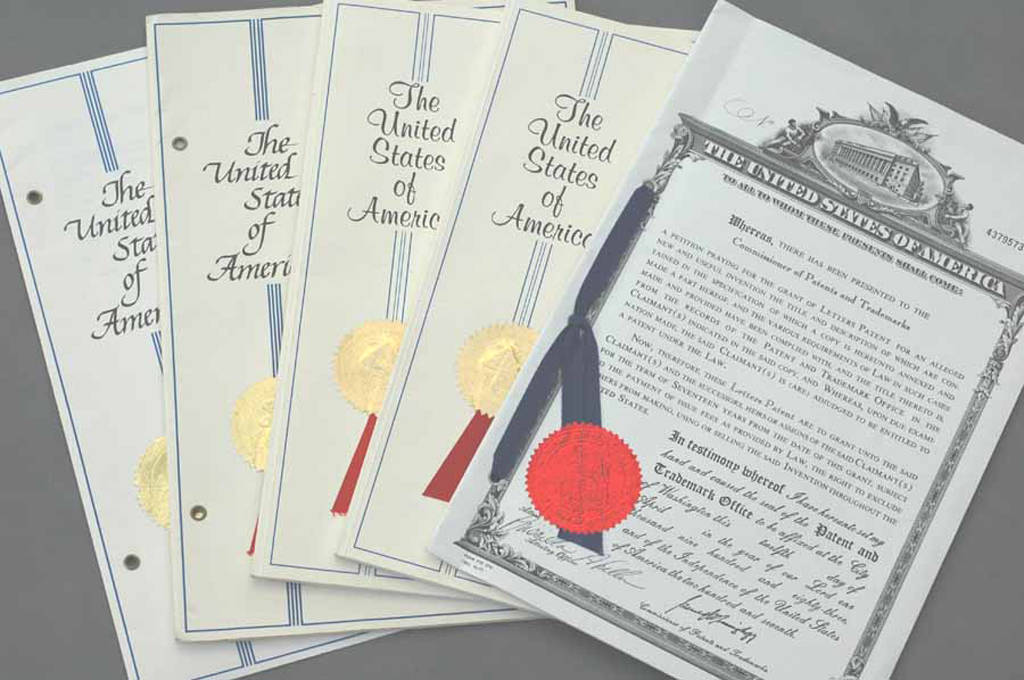

A patent can be a tricky thing as it is. It can be a challenge to determine if you need a patent, but even more so problematic as you look to decide what type of patent you need. For many entrepreneurs, the realization is that they need either a provisional or utility patent, both of which offer very different terms and considerations.

To better help you understand the two, as well as determining which is best for your idea, here are some things to keep in mind regarding provisional and utility patents.

Provisional Patents – A Timely Consideration

One of the easiest ways to determine the difference between a provisional and a utility patent is by considering the timing in which it’s filed.

A patent can be a tricky thing as it is. It can be a challenge to determine if you need a patent, but even more so problematic as you look to decide what type of patent you need. For many entrepreneurs, the realization is that they need either a provisional or utility patent, both of which offer very different terms and considerations.

To better help you understand the two, as well as determining which is best for your idea, here are some things to keep in mind regarding provisional and utility patents.

Provisional Patents – A Timely Consideration

One of the easiest ways to determine the difference between a provisional and a utility patent is by considering the timing in which it’s filed.

A provisional patent can be used to cover an idea for a certain period of time. This gives the inventor time to go through the full patent process, if they choose that it it’s worth it. The truth is that there are a lot of ideas and patents already out there. So while you may have a golden idea that you think nobody has ever had before, that may not be the case. In addition, filing for an idea that has already been granted a utility patent will only disrupt and clog the system for other ideas that actually do need patents. Instead, utility patents are perfect for offering protection for a time period, without having to risk losing everything due to not being filed for soon enough.

Utility Patents – Offering The Best Protection

As mentioned, a utility patent is much more serious and offers longer terms than a provisional patent. Therefore, if an idea is going to be taken to the next steps, then an inventor will want to file for a utility patent. This will help to protect them for years to come, which could mean a life-changing difference in terms of financial gains that come from a product.

Before a family can reap the benefits of a life-changing idea, and the money that comes with it, they also need to invest in the patent itself. This is another large difference between provisional and utility patents, as the latter will cost much more money. Utility patents may also require lawyers to help determine and define legal jargon related to the idea being patented, which may cost additional fees as well.

Which One Is For Me?

A provisional patent can be used to cover an idea for a certain period of time. This gives the inventor time to go through the full patent process, if they choose that it it’s worth it. The truth is that there are a lot of ideas and patents already out there. So while you may have a golden idea that you think nobody has ever had before, that may not be the case. In addition, filing for an idea that has already been granted a utility patent will only disrupt and clog the system for other ideas that actually do need patents. Instead, utility patents are perfect for offering protection for a time period, without having to risk losing everything due to not being filed for soon enough.

Utility Patents – Offering The Best Protection

As mentioned, a utility patent is much more serious and offers longer terms than a provisional patent. Therefore, if an idea is going to be taken to the next steps, then an inventor will want to file for a utility patent. This will help to protect them for years to come, which could mean a life-changing difference in terms of financial gains that come from a product.

Before a family can reap the benefits of a life-changing idea, and the money that comes with it, they also need to invest in the patent itself. This is another large difference between provisional and utility patents, as the latter will cost much more money. Utility patents may also require lawyers to help determine and define legal jargon related to the idea being patented, which may cost additional fees as well.

Which One Is For Me? There is little debate that a utility patent is the best way to go if you have a new idea that has yet to be thought of – and trust us, there are plenty of

them left. However, due to the timing and cost associated with filing, many inventors choose to go the quicker route with a provisional patent. If this is the way you choose to go, understand that your protection will only be granted for a certain period of time and a utility patent will need to be filed for future protection.

Patents protect our greatest ideas and our financial futures. To ensure you have the protection you need, consider this insight for determining if you need a provisional or utility patent.

There is little debate that a utility patent is the best way to go if you have a new idea that has yet to be thought of – and trust us, there are plenty of

them left. However, due to the timing and cost associated with filing, many inventors choose to go the quicker route with a provisional patent. If this is the way you choose to go, understand that your protection will only be granted for a certain period of time and a utility patent will need to be filed for future protection.

Patents protect our greatest ideas and our financial futures. To ensure you have the protection you need, consider this insight for determining if you need a provisional or utility patent.

When you put your heart into something, as well as plenty of blood, sweat, and tears, it's hard to imagine ever parting ways with it. Yet, for many entrepreneurs, somewhere along the way, they may have to consider the idea of giving up equity.

The question is: When do you give up equity in your business or your idea? After all, give in too soon and you may end up giving away too much. Then again, if you refuse to ever give up equity, your business or idea may never get the support it needs.

When you put your heart into something, as well as plenty of blood, sweat, and tears, it's hard to imagine ever parting ways with it. Yet, for many entrepreneurs, somewhere along the way, they may have to consider the idea of giving up equity.

The question is: When do you give up equity in your business or your idea? After all, give in too soon and you may end up giving away too much. Then again, if you refuse to ever give up equity, your business or idea may never get the support it needs.

To help you better determine when the timing is right, here is some insight for when to give up equity in your business.

Be Swept Up Or Swept Away The moment that others catch on to your great idea, no matter what it is, it’s time to start the countdown until you have competitors who are trying to capitalize on your market. It’s very important that you evaluate this exchange closely. If, for example, you cannot keep up with demand, then you are likely to be swept away by your competition. However, if it’s the perfect time to consider equity for acquisition or services, then the added financial support may be what is needed to meet growing demands.

Do Other Burdens Occur While Raising Equity Assistance?

There have been a lot of companies that have put the cart far before the horse, and you should consider their stories and tread lightly in order to avoid your own demise. Considering equity brings in a lot of questions into an organization. If your company is going to be burdened by any sort of equity process, then the overall impact needs to be weighed against the expected benefits. Sometimes growth is inevitable and changes aren’t a problem. But if the organization is in a fragile state, then it’s important to tread lightly to avoid greater disruptions.

Know What Not To Give In On

Considering the exchange of equity for control is going to require managers, owners, and other leaders to make tough decisions. But that’s part of the job and something that should be prepared for the moment that you consider giving up equity. When that time comes, you will do yourself a favor by knowing what you will, and what you won’t, give in on. If, for example, the conditions are not favorable, then tough choices will have to be made. There’s no one-size-fits-all answer and each business is different. Consider yours carefully as you understand what you will, or won’t, give in on.

For many people, the idea of starting a business is a life-long dream that only comes true after invaluable amounts of effort and work. Unfortunately, effort and work may not be enough to get you through. If that happens, your only option may be to consider exchanging equity. Before you do that, make these considerations as you evaluate when to give up equity for your business. Though each business is different, the answers here will help you make a decision that’s best for you.

The moment that others catch on to your great idea, no matter what it is, it’s time to start the countdown until you have competitors who are trying to capitalize on your market. It’s very important that you evaluate this exchange closely. If, for example, you cannot keep up with demand, then you are likely to be swept away by your competition. However, if it’s the perfect time to consider equity for acquisition or services, then the added financial support may be what is needed to meet growing demands.

Do Other Burdens Occur While Raising Equity Assistance?

There have been a lot of companies that have put the cart far before the horse, and you should consider their stories and tread lightly in order to avoid your own demise. Considering equity brings in a lot of questions into an organization. If your company is going to be burdened by any sort of equity process, then the overall impact needs to be weighed against the expected benefits. Sometimes growth is inevitable and changes aren’t a problem. But if the organization is in a fragile state, then it’s important to tread lightly to avoid greater disruptions.

Know What Not To Give In On

Considering the exchange of equity for control is going to require managers, owners, and other leaders to make tough decisions. But that’s part of the job and something that should be prepared for the moment that you consider giving up equity. When that time comes, you will do yourself a favor by knowing what you will, and what you won’t, give in on. If, for example, the conditions are not favorable, then tough choices will have to be made. There’s no one-size-fits-all answer and each business is different. Consider yours carefully as you understand what you will, or won’t, give in on.

For many people, the idea of starting a business is a life-long dream that only comes true after invaluable amounts of effort and work. Unfortunately, effort and work may not be enough to get you through. If that happens, your only option may be to consider exchanging equity. Before you do that, make these considerations as you evaluate when to give up equity for your business. Though each business is different, the answers here will help you make a decision that’s best for you.

Laugh all you want at those crazy TV commercials touting the latest and greatest gadgets, but the As Seen on TV industry is a $350+ billion market.

For more than 30 years, Trevose, Pennsylvania, marketer Bill McAlister, CEO of Top Dog Direct, has been laughing all the way to the bank with some of the most popular As Seen on TV creations, including Mighty Putty, BeActive Brace, Spray Perfect, Futzuki, Stream Clean, Urine Gone and Sobokawa Cloud Pillow. Top Dog Direct even went to the Mojave Desert to pull a plane using a Mighty Putty product.

July 15, 2015: Ambler, Pennsylvania : Top Dog Direct sponsored the 9th annual Big Lebowski night at Ambler Theater in Ambler, PA. Top Dog's popular Night View yellow lens glasses are very similar to John Goodman's character Walter's glasses in the movie. Walter is a Viet Nam vet that wears the distinctive yellow lens glasses throughout the movie day and night. Walter used his glasses while he was in combat. Night Views increases visual acuity at night but many wear them for sports activities such as hunting, skiing and fishing. The night was a complete sellout of the 250 seats in the theater that included a costume contest, trivia contest and of course the cult classic movie. It was made extra special with a complementary pair of Night Views to all in attendance that Steve Silbiger from Top Dog handed out to the revelers. (photo credit: Sarah Silbiger)

Dude!

http://media.montgomerynews.com/2015/07/24/photos-of-the-week-july-19-to-24-2015/#9

http://www.montgomerynews.com/articles/2015/07/27/ambler_gazette/news/doc55aebf4bc8e5d277678698.txt

July 15, 2015: Ambler, Pennsylvania : Top Dog Direct sponsored the 9th annual Big Lebowski night at Ambler Theater in Ambler, PA. Top Dog's popular Night View yellow lens glasses are very similar to John Goodman's character Walter's glasses in the movie. Walter is a Viet Nam vet that wears the distinctive yellow lens glasses throughout the movie day and night. Walter used his glasses while he was in combat. Night Views increases visual acuity at night but many wear them for sports activities such as hunting, skiing and fishing. The night was a complete sellout of the 250 seats in the theater that included a costume contest, trivia contest and of course the cult classic movie. It was made extra special with a complementary pair of Night Views to all in attendance that Steve Silbiger from Top Dog handed out to the revelers. (photo credit: Sarah Silbiger)

Dude!

http://media.montgomerynews.com/2015/07/24/photos-of-the-week-july-19-to-24-2015/#9

http://www.montgomerynews.com/articles/2015/07/27/ambler_gazette/news/doc55aebf4bc8e5d277678698.txt

Anyone can have a great idea that nobody has ever thought of before. At least, they think nobody has thought of it until they do a bit more research to realize that might not be the case. If your product is proprietary, that means that you are the sole owner of the product/idea, or you are given credit for as much, which limits the uses that other people can claim without your approval.

In the past, claiming proprietary rights over a product or idea was complex. You’ve probably heard plenty of stories about the person who lost their idea or product to a much larger company, simply because they did not know how to protect themselves.

Now, thanks to the Internet and the general ease of finding information, it’s easier than ever to determine whether or not your product is already out there or not. However, you may want to think twice before you type your great idea into a search engine, as your idea may not be as safe as you think.

Keeping Your Ideas Safe

The idea of claiming proprietary rights over a product or a service is so that you can be recognized as the first person to think of it. Just imagine how different their stories would be if entrepreneurs like Albert Einstein, Thomas Edison, Bill Gates, or Mark Cuban didn’t have the rights that they need for the products that are synonymous with their success. If you want to ensure that you stay in control over your product or idea, then you need to ensure that you claim proprietary rights over it.

Running Your Products Together

Anyone can have a great idea that nobody has ever thought of before. At least, they think nobody has thought of it until they do a bit more research to realize that might not be the case. If your product is proprietary, that means that you are the sole owner of the product/idea, or you are given credit for as much, which limits the uses that other people can claim without your approval.

In the past, claiming proprietary rights over a product or idea was complex. You’ve probably heard plenty of stories about the person who lost their idea or product to a much larger company, simply because they did not know how to protect themselves.

Now, thanks to the Internet and the general ease of finding information, it’s easier than ever to determine whether or not your product is already out there or not. However, you may want to think twice before you type your great idea into a search engine, as your idea may not be as safe as you think.

Keeping Your Ideas Safe

The idea of claiming proprietary rights over a product or a service is so that you can be recognized as the first person to think of it. Just imagine how different their stories would be if entrepreneurs like Albert Einstein, Thomas Edison, Bill Gates, or Mark Cuban didn’t have the rights that they need for the products that are synonymous with their success. If you want to ensure that you stay in control over your product or idea, then you need to ensure that you claim proprietary rights over it.

Running Your Products Together Some organizations have perfected what it takes to ensure that their products remain proprietary. Take a company like Adobe, for example. Adobe is known for their line of digital products that range from computer support to photo editing. However, the product that might be most useful to Adobe is Acrobat, which is the reader that is used for Portable Document Format – otherwise known as PDFs. Without Acrobat, users cannot view a variety of different files and documents, which makes Adobe an integral, if not irreplaceable, part of the equation.

For entrepreneurs who want to ensure the propriety of their product(s), making different elements along the way might be key. In the event that a competing company comes into the picture and claims improper ownership, you will have the other pieces of the puzzle that limit the usage of the final product. This is an ideal way to save yourself from concerns related to lost proprietary rights, as you will be able to hold multiple links along the line – much like Adobe does.

Making The Most Of What You Have

It’s a cold world that is full of corporate lawyers and overly greedy CEOs. And while there may be nothing that you can do to change that, you can be ready to take whatever comes your way. Many companies have survived the concerns of others taking proprietary rights by making the most of what they have. The popular computer operating system, Linux, for example, offers both free and paid versions. Offering a free version is a way to give users some features, by looking for a switch to another product.

Having a great idea might be what you need to change the outlook of your family fortune. However, keep in mind that your great idea might already be out there. If it’s not and you can claim proprietary over it, then it’s vital that you remain protected by legal concerns. Consider the tips here for determining whether or not your idea or product is proprietary, and then do whatever it takes to make the most of the idea you’ve had.

Some organizations have perfected what it takes to ensure that their products remain proprietary. Take a company like Adobe, for example. Adobe is known for their line of digital products that range from computer support to photo editing. However, the product that might be most useful to Adobe is Acrobat, which is the reader that is used for Portable Document Format – otherwise known as PDFs. Without Acrobat, users cannot view a variety of different files and documents, which makes Adobe an integral, if not irreplaceable, part of the equation.

For entrepreneurs who want to ensure the propriety of their product(s), making different elements along the way might be key. In the event that a competing company comes into the picture and claims improper ownership, you will have the other pieces of the puzzle that limit the usage of the final product. This is an ideal way to save yourself from concerns related to lost proprietary rights, as you will be able to hold multiple links along the line – much like Adobe does.

Making The Most Of What You Have

It’s a cold world that is full of corporate lawyers and overly greedy CEOs. And while there may be nothing that you can do to change that, you can be ready to take whatever comes your way. Many companies have survived the concerns of others taking proprietary rights by making the most of what they have. The popular computer operating system, Linux, for example, offers both free and paid versions. Offering a free version is a way to give users some features, by looking for a switch to another product.

Having a great idea might be what you need to change the outlook of your family fortune. However, keep in mind that your great idea might already be out there. If it’s not and you can claim proprietary over it, then it’s vital that you remain protected by legal concerns. Consider the tips here for determining whether or not your idea or product is proprietary, and then do whatever it takes to make the most of the idea you’ve had.

Determining the perfect price for your product is going to be one of the most difficult challenges you have as an entrepreneur. But even once your prices are stable and set, you’ll quickly realize that initial price points are just the beginning of a much larger equation. Depending on how you change those prices could have a large impact on your overall sales.

To ensure that you don’t lose customers due to inconsistent prices, you need to justify and consider any changes you make. In order to assist you with this process, here are some tips for dropping product prices effectively.

Determine The Right Amount

Entrepreneurs that have a physical product likely won’t be able to discount their goods from several thousand dollars to a fraction of that price. However, an artist or author who has a digital copy of their work may be more willing to bring their prices down, or even give a limited amount away, if it means that they will get more recognition for their artistic abilities. It’s very important that, no matter what the product is, it is discounted proportionately. Keep reading to find out how to determine that proportion.

Avoid Sporadic Spikes

One thing that entrepreneurs won’t want to do is continually change their prices with sporadic and drastic spikes. For example, going back and forth from $10 to $1 for a product may help you get more sales at first, but the long-run effects will result in low price expectations. In addition, sporadic spikes in price also leads to customer doubt, which makes it nearly impossible to build loyalty. The lesson to learn here might just be that less frequent price changes could have a more effective impact for overall sales.

Determining the perfect price for your product is going to be one of the most difficult challenges you have as an entrepreneur. But even once your prices are stable and set, you’ll quickly realize that initial price points are just the beginning of a much larger equation. Depending on how you change those prices could have a large impact on your overall sales.

To ensure that you don’t lose customers due to inconsistent prices, you need to justify and consider any changes you make. In order to assist you with this process, here are some tips for dropping product prices effectively.

Determine The Right Amount

Entrepreneurs that have a physical product likely won’t be able to discount their goods from several thousand dollars to a fraction of that price. However, an artist or author who has a digital copy of their work may be more willing to bring their prices down, or even give a limited amount away, if it means that they will get more recognition for their artistic abilities. It’s very important that, no matter what the product is, it is discounted proportionately. Keep reading to find out how to determine that proportion.

Avoid Sporadic Spikes

One thing that entrepreneurs won’t want to do is continually change their prices with sporadic and drastic spikes. For example, going back and forth from $10 to $1 for a product may help you get more sales at first, but the long-run effects will result in low price expectations. In addition, sporadic spikes in price also leads to customer doubt, which makes it nearly impossible to build loyalty. The lesson to learn here might just be that less frequent price changes could have a more effective impact for overall sales.

Have A Reason

If it’s a holiday, have a sale. If you’ve hired a new employee, have a sale. If the weather is hot out, have a sale. The point is, always offer a reason for the sale that you are having. Therefore, when you put your prices back to regular levels, you’ll have an honest explanation for the customer. Otherwise, sales that occur, “just because” might develop customer resentment moving forward.

Consider The Alternative Options

We live in a world where things are continually being outdated and replaced. Whether it’s video games, technology, cars, or clothing, we are a generation where new is certainly “in.” With that in mind, it’s important that entrepreneurs do not hold onto their items, or overprice them, once the trend has died down. Take a look at smartphones, which go down drastically in price once the latest version comes out. Those prices continue to go down as newer technology is released. With your product, consider it’s lifeline and any updated versions. If they are available, you may be better off selling things quickly versus holding on and hoping for sales in the future.

Every business is different, as are the products they sell. However, there isn’t an industry out there that doesn’t have to consider price changes. But before you go and change the prices on your product, be sure to consider these tips for effective change strategies.

Have A Reason

If it’s a holiday, have a sale. If you’ve hired a new employee, have a sale. If the weather is hot out, have a sale. The point is, always offer a reason for the sale that you are having. Therefore, when you put your prices back to regular levels, you’ll have an honest explanation for the customer. Otherwise, sales that occur, “just because” might develop customer resentment moving forward.

Consider The Alternative Options

We live in a world where things are continually being outdated and replaced. Whether it’s video games, technology, cars, or clothing, we are a generation where new is certainly “in.” With that in mind, it’s important that entrepreneurs do not hold onto their items, or overprice them, once the trend has died down. Take a look at smartphones, which go down drastically in price once the latest version comes out. Those prices continue to go down as newer technology is released. With your product, consider it’s lifeline and any updated versions. If they are available, you may be better off selling things quickly versus holding on and hoping for sales in the future.

Every business is different, as are the products they sell. However, there isn’t an industry out there that doesn’t have to consider price changes. But before you go and change the prices on your product, be sure to consider these tips for effective change strategies.

Anyone can be an inventor. While many people will likely read that and think that only great minds like Albert Einstein or Thomas Edison have what it takes to come up with new ideas that the world will need, the truth is that anyone can come up with great ideas no matter who they are.

No matter what industry you are in, there are different people that come together to make up the entirety of the field. The same is to be said about inventors and entrepreneurs. There is no one-size-fits-all mold that makes the perfect inventor. Instead, knowing what type of inventor you are will help you make the most of your visionary goals.

In order to succeed, you must first look at yourself. Therefore, here are some common character types for determining what type of inventor you might be.

The Creator

Many inventors start as the creator type. They have a great idea and they want to do whatever it takes to make it come to fruition. These inventors are able to see a problem, find a solution, and then create a way for the masses to use it. Creators are often the mind behind the inventor process, but they may not be the only important figure.

The Financier

Some people don’t have creative ideas, but that doesn’t stop them from still becoming an inventor. These inventor-types often have financial means that allow them to hire other people to work on ideas for them. The goal here is to find the best ideas and then make the most from them. Even if the idea wasn’t solely theirs, the financier is still an inventor just like the creator.

Anyone can be an inventor. While many people will likely read that and think that only great minds like Albert Einstein or Thomas Edison have what it takes to come up with new ideas that the world will need, the truth is that anyone can come up with great ideas no matter who they are.

No matter what industry you are in, there are different people that come together to make up the entirety of the field. The same is to be said about inventors and entrepreneurs. There is no one-size-fits-all mold that makes the perfect inventor. Instead, knowing what type of inventor you are will help you make the most of your visionary goals.

In order to succeed, you must first look at yourself. Therefore, here are some common character types for determining what type of inventor you might be.

The Creator

Many inventors start as the creator type. They have a great idea and they want to do whatever it takes to make it come to fruition. These inventors are able to see a problem, find a solution, and then create a way for the masses to use it. Creators are often the mind behind the inventor process, but they may not be the only important figure.

The Financier

Some people don’t have creative ideas, but that doesn’t stop them from still becoming an inventor. These inventor-types often have financial means that allow them to hire other people to work on ideas for them. The goal here is to find the best ideas and then make the most from them. Even if the idea wasn’t solely theirs, the financier is still an inventor just like the creator.

The Idea Machine

Having a good idea turn into something much larger than you ever could’ve imagined can be addicting. For some inventors, they simply can’t get enough of creating new things based off the ideas that they have. And once you’ve succeeded and have financial backing due to one venture, it becomes much easier to go forward with other ideas as well.

The important thing to note here is that inventors that come up with a lot of ideas should be careful to limit what they actually move forward with. For those inventors who are still looking for their big break, having too many ideas may limit your focus on one solid one. Or if you’ve been lucky enough to taste the success from one of your inventions, you’ll want to ensure that you don’t sink your riches into a new idea that won’t be as successful. Idea machine inventors are certainly out there, including plenty of successful ones who manage their thoughts well. However, understand the difference between an idea and a physical product, and do your best to focus your attention on the better ideas that you have.

The Could-Have-Been

What might be out there more than any other type of inventor is the could-have-been. These are the inventors who had a great idea or the finances to make it happen, but instead they sat around all day and never chased their dreams. The streets are littered with these inventor types, and you don’t want to be one of them. Therefore, take your idea and make the most of it now that you know what type of inventor you are.

The Idea Machine

Having a good idea turn into something much larger than you ever could’ve imagined can be addicting. For some inventors, they simply can’t get enough of creating new things based off the ideas that they have. And once you’ve succeeded and have financial backing due to one venture, it becomes much easier to go forward with other ideas as well.

The important thing to note here is that inventors that come up with a lot of ideas should be careful to limit what they actually move forward with. For those inventors who are still looking for their big break, having too many ideas may limit your focus on one solid one. Or if you’ve been lucky enough to taste the success from one of your inventions, you’ll want to ensure that you don’t sink your riches into a new idea that won’t be as successful. Idea machine inventors are certainly out there, including plenty of successful ones who manage their thoughts well. However, understand the difference between an idea and a physical product, and do your best to focus your attention on the better ideas that you have.

The Could-Have-Been

What might be out there more than any other type of inventor is the could-have-been. These are the inventors who had a great idea or the finances to make it happen, but instead they sat around all day and never chased their dreams. The streets are littered with these inventor types, and you don’t want to be one of them. Therefore, take your idea and make the most of it now that you know what type of inventor you are.

Whether you realize it or not, everyone has had a great idea at least once in their lifetime. For some people, it’s a social media site that connects everyone in the world. For others, it may just be a simple life-hack that makes it easier to pack a suitcase. Whatever it is, all products start as a simple idea.

However, while all products may start as an idea, it’s important to realize that not all ideas will turn into a product. In fact, an entrepreneur may have the most desirable idea in the entire world, but it won’t mean anything if they can’t figure out a way to turn it into a tangible product that people will buy.

Whether you are a struggling entrepreneur who cannot figure out why sales are stagnant, or someone who is sitting on a gold mine without knowing it, here are some ways to help you determine if you have a product or an idea.

Are Others In Need Of The Product?

Whether you realize it or not, everyone has had a great idea at least once in their lifetime. For some people, it’s a social media site that connects everyone in the world. For others, it may just be a simple life-hack that makes it easier to pack a suitcase. Whatever it is, all products start as a simple idea.

However, while all products may start as an idea, it’s important to realize that not all ideas will turn into a product. In fact, an entrepreneur may have the most desirable idea in the entire world, but it won’t mean anything if they can’t figure out a way to turn it into a tangible product that people will buy.

Whether you are a struggling entrepreneur who cannot figure out why sales are stagnant, or someone who is sitting on a gold mine without knowing it, here are some ways to help you determine if you have a product or an idea.

Are Others In Need Of The Product? Remember that life-hack that was mentioned earlier? Maybe it’s an idea that you have that is perfect for your home due to the way your staircase is designed or because of it’s layout. Now you need to consider whether that same idea would be feasible for everyone else’s household as well.

The point here to consider is that you may have the perfect idea to fix a specific flaw, but it may not be something that you can turn into a tangible product. However, if it’s something that others do need, then it opens the doors for potential success.

Have You Created A Mockup Or Template Design?

You’ll want to ensure that you are protected before you go around showing everyone your great idea. Even your friends and family may start to get a bit greedy if your idea is a life-changer, and having a mockup of the initial idea or design will help protect yourself against any concerns. In addition, a physical mockup or a template design will help to show others just how much of a difference your product will make on their lives.

Remember that life-hack that was mentioned earlier? Maybe it’s an idea that you have that is perfect for your home due to the way your staircase is designed or because of it’s layout. Now you need to consider whether that same idea would be feasible for everyone else’s household as well.

The point here to consider is that you may have the perfect idea to fix a specific flaw, but it may not be something that you can turn into a tangible product. However, if it’s something that others do need, then it opens the doors for potential success.

Have You Created A Mockup Or Template Design?

You’ll want to ensure that you are protected before you go around showing everyone your great idea. Even your friends and family may start to get a bit greedy if your idea is a life-changer, and having a mockup of the initial idea or design will help protect yourself against any concerns. In addition, a physical mockup or a template design will help to show others just how much of a difference your product will make on their lives.

What Else Is Already Out There?

There are plenty of ways to make money by piggybacking off the success of others,but it’s also important to avoid over-flooding the market. You may have the perfect idea to improve an already existing product, making its use even better. However, you’ll want to avoid pushing things that have already been done repeatedly. Keep in mind that you cannot reinvent the wheel and putting money into an idea that tries to do so would likely not result in a positive investment.

There are plenty of great ideas out there. For anyone who thinks that all the good ones have already been taken, those are the type of people who will never benefit from an innovative and creative mindset. But if you truly want to be successful, it’s going to take much more than innovation and creativity. Instead, consider these tips for determining whether you have just an idea or an actual product, and then figure out how to make the most of what you have.

There are plenty of ways to make money by piggybacking off the success of others,but it’s also important to avoid over-flooding the market. You may have the perfect idea to improve an already existing product, making its use even better. However, you’ll want to avoid pushing things that have already been done repeatedly. Keep in mind that you cannot reinvent the wheel and putting money into an idea that tries to do so would likely not result in a positive investment.

There are plenty of great ideas out there. For anyone who thinks that all the good ones have already been taken, those are the type of people who will never benefit from an innovative and creative mindset. But if you truly want to be successful, it’s going to take much more than innovation and creativity. Instead, consider these tips for determining whether you have just an idea or an actual product, and then figure out how to make the most of what you have.

Having another company offer financial support for your own is a double-edged sword that all entrepreneurs should pay for. On one hand, it’s great to know that someone sees enough potential in your business to want to take it to the next level. On the other hand, it can be a struggle to determine just how much to give, while also maintaining control over the company you’ve worked so hard to build.

In the event that a potential investor is interested in your business, they may offer financial support in return for equity stakes or a returned royalty. Both of these forms of repayment offer varying considerations that need to be made before agreeing to terms. If an entrepreneur fails to do such, they may end up with unfavorable conditions while working on something that was once considered solely theirs.

In order to determine which is best for you, here is a look at equity vs. royalty and an explanation of what the difference is.

Equity – A Set Deal

Equity is commonly a set deal that offers financial support in exchange for a stake or percentage in the company. For example, an investor may offer $25,000 in exchange for a percentage of the company based on an evaluation that they consider being fair. It’s up to the entrepreneur to determine whether or not they value the company at the same rate, or if they are willing to give up a percentage of their company for financial support.

Having another company offer financial support for your own is a double-edged sword that all entrepreneurs should pay for. On one hand, it’s great to know that someone sees enough potential in your business to want to take it to the next level. On the other hand, it can be a struggle to determine just how much to give, while also maintaining control over the company you’ve worked so hard to build.

In the event that a potential investor is interested in your business, they may offer financial support in return for equity stakes or a returned royalty. Both of these forms of repayment offer varying considerations that need to be made before agreeing to terms. If an entrepreneur fails to do such, they may end up with unfavorable conditions while working on something that was once considered solely theirs.

In order to determine which is best for you, here is a look at equity vs. royalty and an explanation of what the difference is.

Equity – A Set Deal

Equity is commonly a set deal that offers financial support in exchange for a stake or percentage in the company. For example, an investor may offer $25,000 in exchange for a percentage of the company based on an evaluation that they consider being fair. It’s up to the entrepreneur to determine whether or not they value the company at the same rate, or if they are willing to give up a percentage of their company for financial support.

As the business grows, that stake that the investor has can be very important. That can lead to more control over decisions, as well as a larger repayment in the event that the company explodes and becomes very popular.

It’s important to note that giving up equity in exchange for financial support is something that many entrepreneurs must do if they want their idea to succeed. While it may be difficult to consider giving up part of a company, it’s often the only option that will help avoid failure.

Royalty – A Proportionate Repayment

With a royalty, there is also an investor who will offer financial support to the company. However, what changes is that the return for the investment comes in the form of a percentage based off sales. For example, an investor may offer $25,000 in exchange for a percentage of all sales moving forward. That percentage does not have to be tied to any control over the company, but instead just acts as a financial return on an investment.

A royalty gets tricky because it can be ideal for small business’ that do not have a lot of sales. However, if you end up agreeing to a royalty payment and then your product explodes, the returned profits can quickly become disproportionate in relation to the initial $25,000 investment. To avoid this, companies should consider multiple tiers and other levels of payouts, in the event that a royalty payment is the decided upon option.

What’s Best For Your Business?

As the business grows, that stake that the investor has can be very important. That can lead to more control over decisions, as well as a larger repayment in the event that the company explodes and becomes very popular.

It’s important to note that giving up equity in exchange for financial support is something that many entrepreneurs must do if they want their idea to succeed. While it may be difficult to consider giving up part of a company, it’s often the only option that will help avoid failure.

Royalty – A Proportionate Repayment

With a royalty, there is also an investor who will offer financial support to the company. However, what changes is that the return for the investment comes in the form of a percentage based off sales. For example, an investor may offer $25,000 in exchange for a percentage of all sales moving forward. That percentage does not have to be tied to any control over the company, but instead just acts as a financial return on an investment.

A royalty gets tricky because it can be ideal for small business’ that do not have a lot of sales. However, if you end up agreeing to a royalty payment and then your product explodes, the returned profits can quickly become disproportionate in relation to the initial $25,000 investment. To avoid this, companies should consider multiple tiers and other levels of payouts, in the event that a royalty payment is the decided upon option.

What’s Best For Your Business? Now that you know the difference between equity and royalty, the question remains as to which is best for your business. While this will depend greatly on your own circumstances, consider the information presented here when determining which option will provide you with the best chances for success moving forward with your company and your dreams.

Now that you know the difference between equity and royalty, the question remains as to which is best for your business. While this will depend greatly on your own circumstances, consider the information presented here when determining which option will provide you with the best chances for success moving forward with your company and your dreams.

For those that love watching prime time television, you’ve likely seen a show called Shark Tank. If you haven’t, it revolves around the hopes and dreams of individuals as they pitch their ideas to a panel of well-known and often flamboyant entrepreneurs. Every once in a while, there is a success story of someone who pairs with one of those entrepreneurs, and the results can be a life changing experience.

For those that love watching prime time television, you’ve likely seen a show called Shark Tank. If you haven’t, it revolves around the hopes and dreams of individuals as they pitch their ideas to a panel of well-known and often flamboyant entrepreneurs. Every once in a while, there is a success story of someone who pairs with one of those entrepreneurs, and the results can be a life changing experience.

Then again, what you rarely see on Shark Tank is the post-production scenarios where the panel of entrepreneurs don’t go through with the deals they say they will. That’s right - there are plenty of scenarios when the sharks lose the hunger that they had on screen and post production results in the entrepreneur not getting the deal they thought they would. There are a ton of different reasons as to why this might happen, but the end result is typically a frustrated and confused entrepreneur.

However, hopeful entrepreneurs should understand that Shark Tank is not the only option for becoming a success. Sure, it’s a good way for you to get on television, which gives excellent exposure for your brand. But if you get find yourself agreeing to unfavorable terms with one of the Sharks, you could be in for a lifetime of regret.

Instead, there are equally as successful companies out there that can provide everything that Shark Tank does. A company like Top Dog Direct has a track record for turning small businesses into big successes. Unlike Shark Tank, working with TDD means that entrepreneurs have less television antics to deal with (i.e. Mr. Wonderful) and genuine one-on-one approach. No ratings, just straight business talk.

You may be thinking that neither Shark Tank, Top Dog Direct, or any other sort of company is worth it. However, it’s important to keep in mind just how many doors one of these firms can open.

If you have driven a car before, it’s easy to navigate your way through the twists and turns on the road. However, if you’ve never been behind the wheel of a car, then even the slightest road bump may cause for some serious disruptions.

Then again, what you rarely see on Shark Tank is the post-production scenarios where the panel of entrepreneurs don’t go through with the deals they say they will. That’s right - there are plenty of scenarios when the sharks lose the hunger that they had on screen and post production results in the entrepreneur not getting the deal they thought they would. There are a ton of different reasons as to why this might happen, but the end result is typically a frustrated and confused entrepreneur.

However, hopeful entrepreneurs should understand that Shark Tank is not the only option for becoming a success. Sure, it’s a good way for you to get on television, which gives excellent exposure for your brand. But if you get find yourself agreeing to unfavorable terms with one of the Sharks, you could be in for a lifetime of regret.

Instead, there are equally as successful companies out there that can provide everything that Shark Tank does. A company like Top Dog Direct has a track record for turning small businesses into big successes. Unlike Shark Tank, working with TDD means that entrepreneurs have less television antics to deal with (i.e. Mr. Wonderful) and genuine one-on-one approach. No ratings, just straight business talk.

You may be thinking that neither Shark Tank, Top Dog Direct, or any other sort of company is worth it. However, it’s important to keep in mind just how many doors one of these firms can open.

If you have driven a car before, it’s easy to navigate your way through the twists and turns on the road. However, if you’ve never been behind the wheel of a car, then even the slightest road bump may cause for some serious disruptions.

The same is to be said about business, entrepreneurship, and having an idea. If you have built a business, or even multiple businesses before, then the path ahead of you may not look as daunting. But if you’ve never built a business before, or if you’ve tried to build a business and it failed, then having a helping hand can be the shining light that you need. Top Dog Direct can be that helping hand that assists entrepreneurs in reaching their goals. In fact, Top Dog Direct has seen dozens of their cast off “winners” go on to trade shows and future success.

Because it’s on primetime television, Shark Tank gets a lot of credit as being the guys who find small ideas before they are big businesses. However, it’s important to realize that those sharks are not the only fish in the sea. Instead, there are companies like Top Dog Direct that can unlock doors just as well as those TV personalities. TDD has a proven track record for success, including helping small ideas turn into tangible life-changing businesses. If you want to take your idea from step one to step twelve, contact Top Dog Direct and turn your idea into reality!

The same is to be said about business, entrepreneurship, and having an idea. If you have built a business, or even multiple businesses before, then the path ahead of you may not look as daunting. But if you’ve never built a business before, or if you’ve tried to build a business and it failed, then having a helping hand can be the shining light that you need. Top Dog Direct can be that helping hand that assists entrepreneurs in reaching their goals. In fact, Top Dog Direct has seen dozens of their cast off “winners” go on to trade shows and future success.

Because it’s on primetime television, Shark Tank gets a lot of credit as being the guys who find small ideas before they are big businesses. However, it’s important to realize that those sharks are not the only fish in the sea. Instead, there are companies like Top Dog Direct that can unlock doors just as well as those TV personalities. TDD has a proven track record for success, including helping small ideas turn into tangible life-changing businesses. If you want to take your idea from step one to step twelve, contact Top Dog Direct and turn your idea into reality!

It’s not uncommon to dream of wealth and riches. Whether you’d spend your days traveling the world in your private jet, or simply giving back to those less fortunate, we all have a bucket list of ideas that we’d surely pursue if the financial means were there.

For many people, the idea of being wealthy seems to be attainable only if you are lucky. For example, maybe you’ll win the lottery or hit it big on a game of blackjack at the casino. But before you go and throw your money at the lottery in hopes of achieving wealthier standards in life, you may want to consider how that money would be better instead used for investing in an invention idea that you have.

In fact, here are some reasons why inventing is better than winning the lottery.

It Is Your Idea

Let’s say that you are someone who wins the lottery. You will win a lot of money, and that will be great. Unfortunately, the downside is that people will always look at you as the person who came into wealth based off luck and chance. However, if you invent something and become wealthy, people will look at your in a more respectful and admirable way. While you may think that money is money and your riches will help you not care what others think, the truth is that mindset probably won’t last long. Therefore, turn your mindset towards making an idea come to life, and you’ll think the taste of victory is much sweeter than that of just winning the lottery.

It’s not uncommon to dream of wealth and riches. Whether you’d spend your days traveling the world in your private jet, or simply giving back to those less fortunate, we all have a bucket list of ideas that we’d surely pursue if the financial means were there.

For many people, the idea of being wealthy seems to be attainable only if you are lucky. For example, maybe you’ll win the lottery or hit it big on a game of blackjack at the casino. But before you go and throw your money at the lottery in hopes of achieving wealthier standards in life, you may want to consider how that money would be better instead used for investing in an invention idea that you have.

In fact, here are some reasons why inventing is better than winning the lottery.

It Is Your Idea

Let’s say that you are someone who wins the lottery. You will win a lot of money, and that will be great. Unfortunately, the downside is that people will always look at you as the person who came into wealth based off luck and chance. However, if you invent something and become wealthy, people will look at your in a more respectful and admirable way. While you may think that money is money and your riches will help you not care what others think, the truth is that mindset probably won’t last long. Therefore, turn your mindset towards making an idea come to life, and you’ll think the taste of victory is much sweeter than that of just winning the lottery.

It Will Last Forever

You’ve probably heard the horror stories of lottery winners who blow their money in just a few short years, only to end up back where they were in the first place. How does this happen? It’s typically because people who come into wealthy quickly do not know how to manage their finances properly. On the other hand, when you invent an idea or start a business, you understand what it’s like to struggle to succeed. While there are some stories of quick success, most entrepreneurs have heard enough “no’s” and “get out’s” that every penny is still incredibly valuable. That’s why they will work to preserve the money for as long as they can.

In addition, business can be passed from generation to generation. After all, look how guys like Henry Ford and John Rockefeller created legacies that their families still bask in today. This is much more likely to happen if you are creating your destiny through invention, versus someone who just became rich thanks to the lottery.

Your Odds Are Better

Finally, the truth is that your odds may simply be better if you put your efforts towards inventing instead of the lottery. Maybe you don’t hit the jackpot and come up with a billion dollar idea like Facebook or Twitter. But if you came up with an idea that at least makes you a substantial amount of money each month, most people would probably happily take that. Your odds are higher to achieve that than they are to win the lottery.

Winning the lottery would be cool, there is no doubt about it. But being wealthy due to success and achievement is better any day of the week.

It Will Last Forever

You’ve probably heard the horror stories of lottery winners who blow their money in just a few short years, only to end up back where they were in the first place. How does this happen? It’s typically because people who come into wealthy quickly do not know how to manage their finances properly. On the other hand, when you invent an idea or start a business, you understand what it’s like to struggle to succeed. While there are some stories of quick success, most entrepreneurs have heard enough “no’s” and “get out’s” that every penny is still incredibly valuable. That’s why they will work to preserve the money for as long as they can.

In addition, business can be passed from generation to generation. After all, look how guys like Henry Ford and John Rockefeller created legacies that their families still bask in today. This is much more likely to happen if you are creating your destiny through invention, versus someone who just became rich thanks to the lottery.

Your Odds Are Better

Finally, the truth is that your odds may simply be better if you put your efforts towards inventing instead of the lottery. Maybe you don’t hit the jackpot and come up with a billion dollar idea like Facebook or Twitter. But if you came up with an idea that at least makes you a substantial amount of money each month, most people would probably happily take that. Your odds are higher to achieve that than they are to win the lottery.

Winning the lottery would be cool, there is no doubt about it. But being wealthy due to success and achievement is better any day of the week.

Even the best ideas will fall flat if they don’t get in front of the right audience. That is why many entrepreneurs quickly realize that finding the right market is one of the most valuable steps along the way for bringing a new idea to fruition.

The question is: How do you find the right market? After all, you have enough already on your plate, so you don’t have a lot of time for trying things that don’t work.

Luckily, you’ve come to the right place. Here are some tips for finding the right market for your product.

Look To Your Model

Do you have a business model? Many first time entrepreneurs know that they’ve heard of a business model, but the truth is that they don’t know how to put one together. If this is the case, then consider looking to help from a resource like Top Dog Direct. They can help you develop a business plan that will find the best market for your product or idea. A business plan is the foundation of any business, so make sure to build yours as strong as possible.

Even the best ideas will fall flat if they don’t get in front of the right audience. That is why many entrepreneurs quickly realize that finding the right market is one of the most valuable steps along the way for bringing a new idea to fruition.

The question is: How do you find the right market? After all, you have enough already on your plate, so you don’t have a lot of time for trying things that don’t work.

Luckily, you’ve come to the right place. Here are some tips for finding the right market for your product.

Look To Your Model

Do you have a business model? Many first time entrepreneurs know that they’ve heard of a business model, but the truth is that they don’t know how to put one together. If this is the case, then consider looking to help from a resource like Top Dog Direct. They can help you develop a business plan that will find the best market for your product or idea. A business plan is the foundation of any business, so make sure to build yours as strong as possible.

Focus On One Thing

Being a jack of all trades is a common characteristic for an entrepreneur, but it may not help you when it comes to being successful. After all, having your hands on too many things won’t allow you to focus your attention on what makes you the most money. Instead, you can find your specific niche market by focusing your attention to what you do best. In doing so, you’ll not only provide a better product, but you’ll also become more reputable in what you do.

Find The Right Fit

Once you’ve find the right niche to scratch, it might need just a bit of fine tuning. If you haven’t had luck in one market, consider how shifting your focus and attention can help you succeed. There have been countless products that started with the intentions of being something else, only to stumble upon success as what you may know it to be now. This might be the case with your idea as well. Consider how a minor shift can make for a big difference in your business strategy.

Focus On One Thing

Being a jack of all trades is a common characteristic for an entrepreneur, but it may not help you when it comes to being successful. After all, having your hands on too many things won’t allow you to focus your attention on what makes you the most money. Instead, you can find your specific niche market by focusing your attention to what you do best. In doing so, you’ll not only provide a better product, but you’ll also become more reputable in what you do.

Find The Right Fit

Once you’ve find the right niche to scratch, it might need just a bit of fine tuning. If you haven’t had luck in one market, consider how shifting your focus and attention can help you succeed. There have been countless products that started with the intentions of being something else, only to stumble upon success as what you may know it to be now. This might be the case with your idea as well. Consider how a minor shift can make for a big difference in your business strategy.

Look To Other Resources

As mentioned earlier, look to a company like Top Dog Direct to help you build a business plan. The great news is that TDD can help you with a variety of other services as well. This includes finding the right target market, and then pushing your product that way. The road to success in business may look scary, but it’ll be much more appealing if you have a guiding hand who has been through your same struggles before.

Plenty of good ideas have gone unnoticed because they weren’t direction attention from the right places. If you are having a challenge finding your target market, consider the tips here. They could be just what you need to take your idea to the next level and beyond.

Look To Other Resources

As mentioned earlier, look to a company like Top Dog Direct to help you build a business plan. The great news is that TDD can help you with a variety of other services as well. This includes finding the right target market, and then pushing your product that way. The road to success in business may look scary, but it’ll be much more appealing if you have a guiding hand who has been through your same struggles before.

Plenty of good ideas have gone unnoticed because they weren’t direction attention from the right places. If you are having a challenge finding your target market, consider the tips here. They could be just what you need to take your idea to the next level and beyond.

The question that many people who have a great idea wonder is how they take that idea and turn it into a tangible product? And, possibly more importantly, how do you do so before the competitors beat you to the punch?

If having a great idea was all that it took to be successful, we’d all be much more triumphant. Instead, it’ll take a lot of effort and work on your behalf if you want to see your idea come into fruition.

In addition to that hard work and effort, you may also want to consider seeking the assistance of a company that can help you with your ventures. We know what you’re thinking: You just came up with a great idea and you truly believe it will make you millions (if not more) and the last thing you want to do is split that with a company that promises to help. After all, you’ve seen the horror stories on shows like Shark Tank, where money-grubbing entrepreneurs demand exuberant rates in exchange for ultimate control of a company and a bit of TV fame.

Well, that is the type of situation you want to avoid. However, you shouldn’t overlook the value of a company like Top Dog Direct. TDD knows what it’s like to be a small startup with big dreams. That’s why they help entrepreneurs get their ideas jump-started.

The question that many people who have a great idea wonder is how they take that idea and turn it into a tangible product? And, possibly more importantly, how do you do so before the competitors beat you to the punch?

If having a great idea was all that it took to be successful, we’d all be much more triumphant. Instead, it’ll take a lot of effort and work on your behalf if you want to see your idea come into fruition.

In addition to that hard work and effort, you may also want to consider seeking the assistance of a company that can help you with your ventures. We know what you’re thinking: You just came up with a great idea and you truly believe it will make you millions (if not more) and the last thing you want to do is split that with a company that promises to help. After all, you’ve seen the horror stories on shows like Shark Tank, where money-grubbing entrepreneurs demand exuberant rates in exchange for ultimate control of a company and a bit of TV fame.

Well, that is the type of situation you want to avoid. However, you shouldn’t overlook the value of a company like Top Dog Direct. TDD knows what it’s like to be a small startup with big dreams. That’s why they help entrepreneurs get their ideas jump-started.

You might still be thinking that a consulting company like TDD might not be worth it. After all, it sounds like an added expense before any real money is even made. However, keep in mind how much money a consulting team can also help you save and earn in the long run. These companies can help you jump-start your idea and save money, because they’ve already gone through many of the ups and downs that you may experience if you went at it on your own.

Think of all the wasted money that an entrepreneur might spend on product development or marketing that doesn’t even work. Instead, going with a company like Top Dog Direct will help entrepreneurs circumnavigate around those roadblocks. Not to say that the roads won’t be tough, but at least the assistance will be there to better increase the likelihood of success.

When going with a reliable company who has experience growing a business, you can expect:

You might still be thinking that a consulting company like TDD might not be worth it. After all, it sounds like an added expense before any real money is even made. However, keep in mind how much money a consulting team can also help you save and earn in the long run. These companies can help you jump-start your idea and save money, because they’ve already gone through many of the ups and downs that you may experience if you went at it on your own.

Think of all the wasted money that an entrepreneur might spend on product development or marketing that doesn’t even work. Instead, going with a company like Top Dog Direct will help entrepreneurs circumnavigate around those roadblocks. Not to say that the roads won’t be tough, but at least the assistance will be there to better increase the likelihood of success.

When going with a reliable company who has experience growing a business, you can expect:

Have you ever had a great idea for a new product or service, only to think to yourself, “What am I supposed to do next?” What makes this scenario even worse is when you later see your product or service come to fruition, but it’s at the hands of someone else who was able to capitalize on the idea. This sort of thing happens every day, and it can be a life-altering situation for both parties.

The truth is that there is much more to an invention than a good idea. In fact, there is an entire invention process that most products or services have to go through in order to be successful. Here is a look at that process and how inventions come to life.

Documenting Your Idea

Have you ever had a great idea for a new product or service, only to think to yourself, “What am I supposed to do next?” What makes this scenario even worse is when you later see your product or service come to fruition, but it’s at the hands of someone else who was able to capitalize on the idea. This sort of thing happens every day, and it can be a life-altering situation for both parties.

The truth is that there is much more to an invention than a good idea. In fact, there is an entire invention process that most products or services have to go through in order to be successful. Here is a look at that process and how inventions come to life.

Documenting Your Idea

To think that you are the only person to have a great idea is a pretty naive mindset. However, the good news is that you can be the first person to thought of it. The only thing you have to do is document it to say as much. Documenting your idea means that you get a license or patent for it, which you can do through the US Patent and Trademark office. This documentation will do you wonders as you go forward with the invention process.

Determine Your Market

You might think that you should determine your market before you come up with a product. However, plenty of entrepreneurs will tell you that isn’t the case. That is because you might come to realize that you’ve invented something for one purpose or need, but in reality it is much better suited for something else.

Windshield wipers, the ceiling fan, lighters, and many other products were first created with different intentions aside from what they are commonly used for today. Therefore, if you have a great idea and it doesn’t hit with one market, keep in mind that you can target it to other markets as well. Being more open minded will help increase the likelihood of success for the invention.

Bring It To Life

To think that you are the only person to have a great idea is a pretty naive mindset. However, the good news is that you can be the first person to thought of it. The only thing you have to do is document it to say as much. Documenting your idea means that you get a license or patent for it, which you can do through the US Patent and Trademark office. This documentation will do you wonders as you go forward with the invention process.

Determine Your Market

You might think that you should determine your market before you come up with a product. However, plenty of entrepreneurs will tell you that isn’t the case. That is because you might come to realize that you’ve invented something for one purpose or need, but in reality it is much better suited for something else.

Windshield wipers, the ceiling fan, lighters, and many other products were first created with different intentions aside from what they are commonly used for today. Therefore, if you have a great idea and it doesn’t hit with one market, keep in mind that you can target it to other markets as well. Being more open minded will help increase the likelihood of success for the invention.

Bring It To Life

Now that you know the what and who, it’s time to bring your idea to life. This might consist of you building a prototype if you have the ability to do so, or just a mockup if this is more reasonable. A prototype and mockup will also be useful when filing that patent, so be prepared to move this part of the process to a point where it is applicable in your city or state.

Get The Funding You Need

One of the biggest challenges that an entrepreneur will come across in the invention process is finding funding. That’s because after everything you’ve done that was previously mentioned on this list, you’ll still need to market your product to get it to the masses. Instead of running the risk of doing it on your own, working with a small consulting company like Top Dog Direct can provide plenty of benefits. Along with offering financial backing, Top Dog Direct also provides its clients with guidance and leadership with their inventions. This sort of assistance can be very beneficial in terms of the potential success for an invention.

Keep in mind that launching your own product won’t be as simple as these four steps. You’ll instead likely encounter many road bumps and hiccups along the way. But if you plan to have your invention come to the masses, you surely won’t be able to avoid the foundation of the invention process, which will help your inventions come to life.

Now that you know the what and who, it’s time to bring your idea to life. This might consist of you building a prototype if you have the ability to do so, or just a mockup if this is more reasonable. A prototype and mockup will also be useful when filing that patent, so be prepared to move this part of the process to a point where it is applicable in your city or state.

Get The Funding You Need

One of the biggest challenges that an entrepreneur will come across in the invention process is finding funding. That’s because after everything you’ve done that was previously mentioned on this list, you’ll still need to market your product to get it to the masses. Instead of running the risk of doing it on your own, working with a small consulting company like Top Dog Direct can provide plenty of benefits. Along with offering financial backing, Top Dog Direct also provides its clients with guidance and leadership with their inventions. This sort of assistance can be very beneficial in terms of the potential success for an invention.

Keep in mind that launching your own product won’t be as simple as these four steps. You’ll instead likely encounter many road bumps and hiccups along the way. But if you plan to have your invention come to the masses, you surely won’t be able to avoid the foundation of the invention process, which will help your inventions come to life.

If you have a great idea for a new product or service, you may have heard that you need to get a patent. Unfortunately, if you haven’t attended business school, then you may not know where to begin to have that patent filed.

Luckily, you’ve come to the right place. Here is the process to follow, as well as a general timeline for awarding, a patent.

Preliminary Ideas And Searches

We aren’t going to waste a lot of time here, because we assume that you’ve already gone this far. However, it should go without saying that you’ll need to have an idea and do some preliminary searches before you begin filing for a patent. If your idea has already been created and patented, then you will have to change your plans. In addition, searching for other patents may give you additional ideas as well.

Have A Mockup Or Prototype

The next step that you’ll want to follow is having a mockup or prototype created for your idea. If you have experience working with CAD programing or you can draw your own designs, this may not be a problem. However, not having this experience likely means that you’ll need to get assistance. Since you don’t have your patent yet, be sure to have the other person sign a non-disclosure agreement before you show them anything. This documentation will protect you in the time it takes to have your patent filed.

Provisional Patent Filing

If you have a great idea for a new product or service, you may have heard that you need to get a patent. Unfortunately, if you haven’t attended business school, then you may not know where to begin to have that patent filed.

Luckily, you’ve come to the right place. Here is the process to follow, as well as a general timeline for awarding, a patent.

Preliminary Ideas And Searches

We aren’t going to waste a lot of time here, because we assume that you’ve already gone this far. However, it should go without saying that you’ll need to have an idea and do some preliminary searches before you begin filing for a patent. If your idea has already been created and patented, then you will have to change your plans. In addition, searching for other patents may give you additional ideas as well.

Have A Mockup Or Prototype

The next step that you’ll want to follow is having a mockup or prototype created for your idea. If you have experience working with CAD programing or you can draw your own designs, this may not be a problem. However, not having this experience likely means that you’ll need to get assistance. Since you don’t have your patent yet, be sure to have the other person sign a non-disclosure agreement before you show them anything. This documentation will protect you in the time it takes to have your patent filed.

Provisional Patent Filing

A provisional patent isn’t going to be what you build your invention around, but it’ll be enough to at least buy you some time while working on other elements. For example, a provisional patent can be filed while you look for investors or as you begin marketing your product. The safety that comes from a previsional patent will add protection against others stealing your idea, even though it still needs to be filed as a non-provisional patent as well.

Non-Provisional Patent

Within one year of filing for a provisional patent, it’s imperative that investors get non-provisional patents as well. This is the real patent that you will use for years to come, and it will acknowledge you as the creator of the product or service. Again, it’s imperative that this is filed within one year of the provisional patent, or else it could lead to legal issues for the inventor.

Also, mark your calendar for 20 years from now, because that’s when patents expire on ideas. At this point, the patent is no longer valid for the product that was made.

Selling Licenses

During the time that the patent is valid, licenses made be sold to others who are interested in the product or service. Investors then make money off of the selling of licenses, in addition to a royalty in some cases as well.

The patent process is something that simply cannot be overlooked when coming up with a new invention. To ensure the safety of your idea, be sure to consider this timeline for awarding a patent.